Innovation

Innovation From All Corners: The Role of Vendors in the Innovation Ecosystem

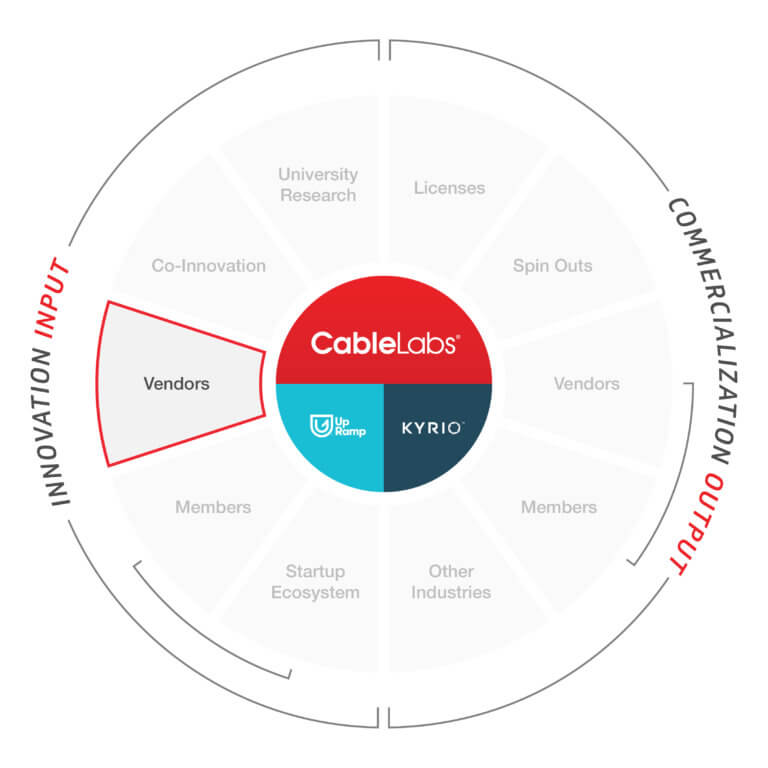

So far we’ve covered the cycle of innovation and commercialization in Transforming Ideas into Solutions and how CableLabs helps turn innovative ideas into reality through startup collaboration and creative licensing agreements. This next part of the Innovation Ecosystem Series focuses on vendors and their role in moving our industry forward.

CableLabs has a long history of vendor community collaboration, teaming up to bring new, innovative ideas to reality. Vendors’ research, unique vantage point and expertise helps shape our innovation roadmaps, inform our members’ business decisions and bring new cutting-edge technology products to market faster and more cost-effectively.

We could cite many examples of successful vendor collaboration, but let’s look at one that has had a widespread and significant market impact: DOCSIS® technology. Its role in the evolving cable modem sector is a great example of how vendor contributions drive the innovation cycle in the industry.

DOCSIS Technology: A Vendor Collaboration Success Story

DOCSIS technology, well established and universally adopted today, was revolutionary at the outset, establishing a telecommunications standard that permitted the addition of high-bandwidth data transfer to an existing cable TV (CATV) system. This meant users could finally experience true interoperability, regardless of the cable vendor they chose.

The Problem

Prior to the creation of the original DOCSIS specifications, many vendors brought proprietary cable modems to market. Each of these proprietary solutions had its own unique, innovative approach to offering broadband internet over a cable network. Some offered solutions for carrying downstream traffic but were weaker in the area of carrying upstream traffic. Some had better Media Access Control (MAC) layer protocols but did not offer great RF performance. Few addressed the issue of security and privacy. None of them individually had the best fix, and none of them captured sufficient market share to make the economics work for truly mass deployment. In short, neither suppliers nor cable customers were finding the optimum resolution.

The Solution

Together with our member companies and industry suppliers, we embarked on an exhaustive process to select the “best of breed” innovations proposed by the vendors. This process involved testing a multitude of different solutions to determine which ones would eventually make it into DOCSIS technology. With each successive generation of DOCSIS technology, innovative contributions to the specifications enable greater speed, lower latency and higher reliability. Now, thanks to our continued collaboration with our vendors, DOCSIS 3.1 technology supports phenomenal speeds of up to 10 gigabits per second downstream and 1 gigabit per second upstream—an amazing achievement that allows our cable operators to stay very competitive in today’s markets.

The Industry Impact

DOCSIS technology catapulted the cable industry into a new service arena, providing broadband internet access to many homes across the country and beyond. Bruce Leichtman, president and principal analyst for Leichtman Research Group, relates the results: "At the end 2Q 2017, cable had a 64% market share. The broadband market share for cable is now at the highest level it has been since the first quarter of 2004."

Thanks to DOCSIS technology, consumers can now enjoy ultra-high definition 4K television, artificial reality (AR), advanced gaming options, IoT and many other benefits of internet connectivity. This, coupled the soon-to-be-delivered 5G, is a very exciting time for broadband innovation.

How We Engage With Our Vendors

Over the last 30 years, we’ve worked hard to develop close working relationships with vendors through various programs and collaboration opportunities. Here are just some of the ways our vendors can engage with us and our member community.

- Working Groups: As Working Group members, vendors get the opportunity to participate in the creation of new specifications and collaborate with other industry professionals.

- Visiting and Contributing Engineer Programs: Vendors can work on-site in our labs as Visiting Engineers or remotely—as Contributing Engineers. They get access to our tools and workspace in exchange for their expertise.

- Draft Specification Reviews: Vendors can get access to draft specifications not yet available to the public. This gives them an opportunity to comment and submit change requests 30 to 60 days prior to issuance.

- Co-innovation Opportunities: Just like with DOCSIS technology, we invite all members and vendors to join us in tackling a specific problem facing the industry and are open to many co-innovation opportunities.

- Events & Showcases: Vendors have multiple opportunities to show off their inventions and connect with cable operators throughout the year. Some of our free events, like the Envision Forum (formerly Connect[ED] Forum), are geared specifically to vendors.

- Kyrio Product Certifications: In our industry, interoperability is key. Through Kyrio, vendors can test their products to make sure they meet all the industry specifications.

Vendors’ work is crucial to our industry on both the innovation and commercialization side of the spectrum. These companies are some of the most prolific sources of great ideas and it’s part of CableLabs’ mission to make sure they are heard by the right people at the right time in the innovation cycle. By working together with both our members and vendors, we can continue to reach our collective goals as an industry and discover new possibilities.

Learn more about vendor collaboration by clicking below.

Events

CableLabs at SCTE-ISBE Cable-Tec Expo® 2018: Learn How We’re Inventing the Future

It’s that time of year again! SCTE-ISBE Cable-Tec Expo brings cable and broadband professionals from around the world together to share trends, innovations and emerging technologies. At this year’s event, we’ll continue to demonstrate how CableLabs’ innovations make next-generation broadband available today and provide solutions for tomorrow’s connectivity challenges.

Here’s a sneak peek of what we’re covering:

- Distributed Access Architecture (DAA): Back by popular demand! We’ll discuss how the CableLabs defined Remote PHY and Flexible MAC Architecture (FMA), which includes the R-MACPHY technology, save operators money and play an essential role in the next generation of cable networks.

- Energy Efficiency: CableLabs provides technical leadership to the industry through influencing energy efficiency voluntary agreements for set-top boxes and small network equipment. We are participating in judging the SCTE Energy 2020 Challenge where two teams will win the opportunity to work with a cable operator to further develop their ideas.

- Full Duplex DOCSIS® 3.1 Technology: Full Duplex DOCSIS technology has the potential to deliver up to 10 gigabits per second of symmetric broadband capacity over the coax portion of the network. We’ll give our update on the next evolution of DOCSIS technology and how CableLabs is preparing to support speed and latency requirements of the future.

- 5G and Broadband Connectivity: 5G wireless networks will require tight integration with high performing fixed broadband networks to offer high capacity, low latency mobile services. We’ll touch upon the latest developments in the intersection between mobile 5G and DOCSIS/ HFC infrastructure and how CableLabs is developing the necessary tools for cable field operators to strategically and technically support 5G.

- Proactive Network Maintenance (PNM): Mother nature isn’t known for her predictably and can cause disruptions in your network. Using CableLabs’ PNM model, you’ll learn how to use machine learning, artificial intelligence and real-time weather analytics to predict the best time to conduct customer repairs to minimize disruptions.

- Fiber to the Home (FTTH) Deployments: Fiber to the home has been deployed across the world by different companies and public institutions. We’ll cover the latest in the standards debates about the technical and economic feasibility of high bit rate.

CableLabs subject matter experts are moderating panel discussions, leading seminars and CEO and President Phil McKinney is speaking at the opening ceremony. Our lineup of speakers and moderators include:

- Ralph Brown, Chief Technology Officer

- Bernardo Huberman, Fellow and Vice President of Core Innovation

- Jon Schnoor, Lead Architect

- Debbie Fitzgerald, Principal Architect

- Karthik Sundaresan, Principal Architect

- Jing Wang, Lead Architect

- Jason Rupe, Principal Architect

- Brian Scriber, Principal Architect

- Curtis Knittle, Vice President of Wired Technologies

- Alberto Campos, Fellow

- Jennifer Andreoli-Fang, Distinguished Technologist

- Doug Jones, Principal Architect

- Don Clarke, Principal Architect

- Ron Ih, Director of Business Development, Kyrio

Through our 61 member companies worldwide, partnerships with top-tier universities and a collaborative ecosystem inside and outside the cable industry, CableLabs is able to create global impact. We are looking forward to seeing you in Atlanta from Oct. 22-25. Visit us at Booth #713 to learn more about how CableLabs is continuing to make breakthroughs towards our vision of a connected future.

Healthcare

Cable’s Role in the Future of Connected Healthcare

A version of this article appeared in S&P Global Market Intelligence in August 2017. You can find the original here.

The connection between cable and healthcare may not be immediately obvious to the casual observer. CableLabs has a vision of the potential future of healthcare in five to ten years’ time that is based on the massive and ubiquitous broadband connectivity that will be available in this time frame. This vision is captured in our video that you can watch at The Near Future Network. After reflecting on this vision, the connection becomes more evident.

Today, in addition to connecting hospitals and clinics, the cable network infrastructure reaches 93% of U.S. homes. This enables cable services to contribute in an increasingly important role in healthcare. Cable operators are able to deliver a cost-effective bundle of broadband, telephone, and television services that meet the connectivity and business needs of hospitals and clinics. In addition to connecting hospitals and clinics, cable companies are offering gigabit speeds to residential customers, completing the connection to the home. Connected healthcare is very important for areas of the country that lack medical resources. For example, GCI, the largest Internet provider in Alaska, is taking the lead in connected healthcare by providing remote Alaskan villages with telemedicine through their ConnectedMD program.

Connecting hospitals and clinics is only the beginning. Remote patient monitoring is becoming an increasingly important aspect in addressing the growing costs of healthcare. The results of a year-long remote patient monitoring pilot from Geneia showed a savings of over $8,000 per monitored patient annually. This kind of remote patient monitoring relies on a robust broadband connection to the home. In September 2015 Cox Communications acquired Trapollo to offer remote patient monitoring significantly reducing the cost of delivering care to patients with chronic ailments. Also in September 2015, Kaiser Permanente announced a pilot of My Pregnancy. A TV app on the Xfinity X1 platform; the app provides timely information for expectant mothers to access clinically validated Kaiser Permanente content.

The demand for healthcare services continues to grow thanks to the reality of an increasing demographic of individuals over the age of sixty-five. Currently, that group makes up 15% of our population, but by 2040 it will be nearly 22%. Coupled with the rising cost of providing healthcare services in hospitals, connected healthcare makes more sense and “cents” than ever. It is well known that treating chronic conditions comprises the highest percentage (as much as 80%) of U.S. healthcare expenditures. Using remote patient monitoring to stay on top of chronic conditions and anticipating potential crises avoids unnecessary ER visits and improves patient outcomes.

Connectivity transcends industries and the issues faced by healthcare are massive, therefore the time for collaboration has arrived. One example of this kind of collaboration with the healthcare industry is cable’s work with the Center for Medical Interoperability (CMI). The West Health Institute study, The Value Of Medical Device Interoperability, estimated that more than $30 billion in annual health care savings could be realized by solving medical device interoperability. CMI was formed to address this problem and is modeled after the CableLabs centralized research and development laboratory. Cable brings its expertise in device interoperability, device security, and certification to the healthcare industry through its participation in CMI’s specification development efforts.

Another example of industry-wide collaboration is our participation in the Open Connectivity Foundation (OCF) which is spearheading network security and interoperability standards for IoT devices. Through OCF, CableLabs and the cable industry is working to increase IoT security to address the associated risks to both the network as well as the privacy of subscribers. CableLabs not only has a board position at OCF, we chair the OCF Security Working group.

The cable industry will have an increasing role in the future of connected healthcare due to their high-capacity, fiber-rich networks that are able to connect patients and providers. CableLabs recognizes this and on April 12th and 13th we produced two back-to-back Inform[ED] Conferences that brought together cable industry technologists with health information management professionals to continue the conversation. Although healthcare IT will become increasingly complex in the future, cable’s solutions are simple, easy to deploy and scalable across the entire healthcare system.

--

Subscribe to our blog to read more about connected healthcare and the innovations we are working on. We hope to inspire the healthcare industry to help us make our vision a reality.

Healthcare

Cable Connects with Healthcare

The connection between cable and healthcare may not be immediately obvious to the casual observer. However, upon further reflection, this connection becomes more evident. Cable companies have been expanding their commercial services to focus on the healthcare vertical.[1] Cable operators are able to deliver a cost-effective bundle of broadband, telephone, and television services that meet the connectivity and business needs of hospitals and clinics.[2] Connected healthcare is very important for areas of the country that lack medical resources. For example, GCI, the largest Internet provider in Alaska, is taking a lead in connected healthcare by providing remote Alaskan villages with telemedicine through their ConnectedMD program.

Connecting hospitals and clinics is only the beginning. Remote patient monitoring is becoming an increasingly important aspect in addressing the growing costs of healthcare. The results of a year-long remote patient monitoring pilot from Geneia showed a savings of over $8,000 per monitored patient annually.[3] This kind of remote patient monitoring relies on a robust broadband connection to the home.

Today, in addition to connecting hospitals and clinics, the cable network infrastructure reaches 93% of U.S. homes.[4] This enables cable services to contribute in an increasingly important role toward healthcare.

The demand for healthcare services continues to grow thanks to the reality of an increasing demographic of individuals over the age of sixty-five: currently that group makes up 15% of our population, but by 2040 it will be nearly 22%.[5] Coupled with the rising cost of providing healthcare services in hospitals, connected healthcare makes more sense and “cents” than ever. It is well known that treating chronic conditions comprises the highest percentage (as much as 80%) of U.S. healthcare expenditures. Using remote patient monitoring to stay on top of chronic conditions and anticipating potential crises avoids unnecessary ER visits and improves patient outcomes.

Connectivity transcends industries and the issues faced by healthcare are massive, therefore the time for collaboration has arrived. One example of this kind of collaboration with the healthcare industry is our work with the Center for Medical Interoperability (CMI). The West Health Institute study, The Value Of Medical Device Interoperability, estimated that more than $30 billion in annual health care savings could be realized by solving medical device interoperability.[6] CMI was formed to address this problem and is modeled after the CableLabs centralized research and development laboratory. CableLabs brings its expertise in device interoperability, device security, and certification to the healthcare industry through its participation in CMI’s specification development efforts.

Another example of industry-wide collaboration is our participation in the Open Connectivity Foundation (OCF) which is spearheading network security and interoperability standards for IoT devices. CableLabs not only has a board position at OCF, we chair the OCF Security Working group. Through OCF, we are working to drive increased IoT security to address the associated risks to both the network as well as the privacy of subscribers.

The organization that I represent, CableLabs, recognizes the increased role that the cable industry will contribute to the healthcare industry of the future. We are producing two back-to-back Inform[ED] Conferences to bring together cable industry technologists with health information management professionals. April 12 will focus on IoT Security and April 13 will cover Connected Healthcare. Please join us in New York City and we look forward to having you join us in this important conversation.

Inform[ED] Connected Healthcare

Event Details

Thursday, April 13, 2017

8:00am to 6:00pm

InterContinental Times Square New York

300 W 44th St.

New York, NY 10036

REGISTER NOW

Footnotes

[1] Comcast - https://business.comcast.com/enterprise/industry-solutions/healthcare

Cox - https://www.cox.com/business/industry-expertise/healthcare.html

Charter - https://enterprise.spectrum.com/solutions/healthcare.html

[2] https://www.ncta.com/platform/broadband-internet/gci-makes-telehealth-as-easy-as-regular-healthcare-in-rural-alaska

[3] https://www.geneia.com/news-events/press-releases/2016/june/geneia-study-finds-remote-patient-monitoring-could-save-more-than-8000-dollars-per-patient-annually

[4] NCTA - https://www.ncta.com/industry-data; Source: NCTA Analysis of SNL Kagan and Census Bureau Estimates

[5] https://aoa.acl.gov/Aging_Statistics/Index.aspx

[6] http://www.westhealth.org/resources/value-of-io-analysis/

By Ralph Brown, Chief Technology Officer, CableLabs.

News

A Sneak Peek of SCTE Cable-Tec Expo

CableLabs and Kyrio will be hosting a booth at the SCTE Cable-Tec Expo 2016. To provide you with a sneak peek of what we plan to show at the event, below are highlights of six demonstrations:

Full Duplex DOCSIS® 3.1 Technology

With Full Duplex DOCSIS 3.1 technology, the HFC network can support 10 Gbps Downstream x 6 Gbps Upstream symmetrical capacities in 1.2 GHz of spectrum. Multi-Gbps symmetric services will meet user demands and support future applications. Learn more about the next evolution of DOCSIS technology.

3.5GHz Shared Spectrum and Wi-Fi Traffic Aggregation

3.5 GHz (3.55 – 3.7GHz) shared spectrum offers the potential democratization of LTE. Cable operators can deploy LTE-based solutions within homes, offices and even in public environments to create low cost mobile networks. See how CableLabs multi-path TCP technology can help cable operators aggregate IP traffic from both 3.5 GHz spectrum and existing Wi-Fi access points to provide their customers with great wireless speeds.

Energy Efficiency of CPE (Consumer Premises Equipment)

CableLabs provides technical leadership to the industry through influencing energy efficiency voluntary agreements for set-top boxes and small network equipment as well as other energy efficiency initiatives. CableLabs also works closely with SCTE Energy 2020 to address end-to-end energy efficiency in the cable infrastructure. Learn more about the voluntary agreement initiatives and see CPE energy efficiency in action!

Automated Leakage Detection and Time Domain Reflectometer (TDR)

Cable operators can automatically gather their own leakage data for use as a diagnostic tool. This new detection method employs GPS and a continuous wave test signal and can pinpoint leakage sources. The leakage data can be used to make Proactive Network Maintenance (PNM) map overlays to speed problem resolution and to prevent LTE interference. The TDR uses standing waves on digital signals to accurately calculate the distance to reflections without interrupting service. Learn more about how these methods can improve network performance.

DOCSIS® 3.1 Profile Management Application (PMA)

The Profile Management Application implements a software application that can configure and manage DOCSIS 3.1 OFDM subcarrier modulation profiles on a DOCSIS 3.1 CMTS. This demonstration shows how PMA interacts with CMTSs, CMs, and other network elements to monitor, create, modify and then assign specific profiles to specific DOCSIS 3.1 CMs to optimize and maximize the capacity on a DOCSIS 3.1 OFDM Channel.

Real World Testing

In a world of constant change and innovation, the need for agility and assurance is crucial. Learn how Kyrio Testing Services provides their customers with the ability to adapt to new requirements, accelerate change, and assure quality of product performance and usability from the end user perspective.

We look forward to meeting you at the SCTE Cable-Tec Expo, Booth # 1424, September 26 – 29 in Philadelphia.

News

NDA Vendor Forum is April 6

The CableLabs annual NDA Vendor Forum is a great opportunity for companies who are interested in developing technologies for the cable industry to get up to speed with the latest technology projects underway at CableLabs. This year’s Forum comes at an exciting time for the industry. CableLabs member companies in the U.S. and abroad are accelerating their plans to deploy gigabit services as well as a range of new services that benefit both residential and commercial subscribers.

We’ll be hosting the all-day event on April 6 here in Colorado. You’ll be able to network with CableLabs staff and other vendors and get any of your questions answered with respect to technology development projects at CableLabs.

At the Forum, we’ll discuss our Wired Technologies project portfolio including DOCSIS® 3.1 technologies, the Converged Cable Access Platform, PON, and our new Open Source Code Community. On the Wireless Technologies front, we’ll share our roadmap for 5G and Millimeter Wave Technologies, Gigabit Wireless Home Networks, Community Wi-Fi, and LTE-Unlicensed. The success of our R&D project roadmap for the next 18 months depends on the substantial technical expertise and engineering contributions from the vendor community and we look forward to the collaboration ahead.

As we announced earlier this year, CableLabs has increased the priority of long term innovation efforts. We’ll be providing information on opportunities to engage in co-innovation and prototyping, our Innovation Boot Camps, and the newly announced UpRamp™ an accelerator program to connect start-up companies with cable operators. And we’ll outline how to take advantage of the full suite of device testing and security services that are now publicly available through Kyrio.

If you are already part of our NDA vendor community, please register for the event. If you are new to the community and interested in attending, please fill out the Confidential Information Access Agreement – (NDA) for the areas you are interested in. There is no cost to join or to attend the Forum, and benefits of NDA membership (no cost) are numerous and include the ability to provide input to our technical specifications before they become public.

I look forward to seeing you in April here in Colorado.

Ralph

Strategy

Downloadable Security and the Future of CableCARDs

The Downloadable Security Technology Advisory Committee (DSTAC) just released its final Report on August 31, 2015. A large number of companies (including CableLabs members) issued a joint statement regarding this Report. All of which naturally raises several questions, such as, what is DSTAC? What does the Report say? And what does it mean for consumers?

A little background first: the DSTAC was created as a result of the Satellite Television Extension and Localism Act Reauthorization (STELAR) bill that was passed in December 2014. Among other things, this bill included a repeal of the set-top box security integration ban on cable operators, also known as the CableCARD mandate. Under the CableCARD mandate, cable operators were not only required to supply CableCARDs to retail cable devices, such as TiVo DVRs, but they were also required to employ CableCARDs in all of their own set-tops, which increased cost and energy consumption, while adding no additional functionality or capability. This requirement was referred to as “common reliance”; that is, in order to ensure that CableCARDs worked properly, cable operators were forced to use the same security technology as retail devices. There were several cable operators and vendors that received CableCARD waivers, but the last NCTA report to the FCC on CableCARD deployment shows the dramatic impact of this regulation. This report states, “there have been over 617,000 CableCARDs deployed for use in retail devices by the nine largest incumbent cable operators. By contrast, those nine companies have more than 53,000,000 operator-supplied set-top boxes with CableCARDs currently deployed.” This means that only approximately 1% of the CableCARDs deployed are for retail devices, the rest are deployed in cable operator-supplied set-top boxes. That is some “common reliance” insurance policy!

Fortunately, with the passage of the STELAR bill, this integration ban expires in December 2015. This means that cable operators will no longer have to employ CableCARDs in their own set-tops. To be crystal clear, this does not mean that cable operators will no longer supply CableCARDs for retail cable devices and they have all committed to supporting retail CableCARD devices for the foreseeable future.

In addition to repealing the integration ban, STELAR directed the FCC Chairman to establish a working group of technical experts that represent the viewpoints of a wide range of stakeholders “to identify, report, and recommend performance objectives, technical capabilities, and technical standards of a not unduly burdensome, uniform, and technology- and platform-neutral software-based downloadable security system designed to promote the competitive availability of navigation devices in furtherance of Section 629 of the Communications Act.” Section 629 of the Communications Act addresses retail availability of “navigation devices.” DSTAC is this working group of technical experts from across Multi-channel Video Program Distributors (MVPDs cable, satellite, telco, and fiber), consumer electronics manufacturers, and consumer advocates. Here is the list of DSTAC members.

One should recognize how daunting a task this was, given the diversity of technologies and architectures deployed across Multi-channel Video Program Distributors (MVPDs) and the fact that the committee had only nine months to generate this Report. As you can imagine, an enormous amount of work, representing millions of dollars of effort, went into the generation of the DSTAC Report. CableLabs played a leadership role in coordinating much of this activity.

Given all of this effort, what does the Report say? As directed by the FCC, the work was broken up into four Working Groups. The output of Working Group 3 produced two security-related proposals, and the output of Working Group 4 produced two proposals addressing non-security issues. The Executive Summary of the Report provides an overview of the DSTAC work.

The most important result of the Report is that there is no collective recommendation for any new FCC technology mandate. And, while the DSTAC report does not provide a consensus recommendation, there were several key points of agreement among the DSTAC members. As described in the Executive Summary, the key points of agreement include:

- Recognition that “there is a wide diversity in delivery networks, conditional access systems, bi-directional communication paths, and other technology choices across MVPDs (and even within MVPDs of a similar type).”

- “None of the proposals recommend a solution based on common reliance[1].”

- Recognition that “it should not be necessary to disturb the potentially multiple present and future CA/DRM[2] system choices made by cable, DBS and IPTV systems, which effectively leaves in place several proprietary systems for delivering digital video programming and services across MVPDs.”

- Conversely, recognition “that it is unreasonable to expect that retail devices connect directly to all of the various MVPDs’ access networks; rather they should connect via an IP (Internet Protocol) connection with specified APIs[3]/protocols, via the MVPD’s cloud and/or from within the home.”

- Recognition “that it is unreasonable to expect that MVPDs will modify their access networks to converge on a single common security solution.”

- Recognition “that the downloaded security components need to remain in the control of the MVPD.”

- Recognition that “[i]t would not be a step forward or economically viable to require an environment in which a retail manufacturer would have to equip a device with RF tuners for cable and satellite, [and] varied semiconductor platforms, to support the dozen-plus proprietary CAS technologies that are currently in use.”

- Recognition that “[i]t is not reasonable to expect that all MVPDs will re-architect their networks in order to converge on a common solution.”

So, given all this, what does the Report mean for consumers? What the Report does provide is an extensive overview of the current support of MVPDs for retail devices. A good example of this is the table below. Some amazing statistics can be extracted from this table and are presented in the Report.

- The total number of retail devices in the US that can be served by an MVPD app is over: 450 million devices

- The percentage of these retail devices that can be served by one or more MVPD apps is: 96%

- The percentage of these retail devices that can be served by an app from all of the top 10 MVPDs is: 67%

- There have been over 56 million downloads of the top 10 MVPDs’ iOS and Android apps and growing every month

This means that there are almost twice as many retail devices on average per household, that are capable of receiving MVPD content, than there are MVPD provided set-tops! Consumers can take comfort knowing that a wide variety of their retail devices can receive MVPD services.

| Retail Device | United States Units | MVPD Apps |

| Android phones[4] | 92,036,000 | All top 10 MVPDs[5] |

| PCs & Macs w/Broadband[6] | 85,358,000 | All top 10 MVPDs |

| iOS phones4 | 71,449,000 | All top 10 MVPDs |

| Xbox 360[7] | 48,460,000 | 5 of the top 10 MVPDs |

| Android Tablets[8] | 43,260,000 | All top ten MVPDs |

| PlayStation 37 | 29,160,000 | 2 of the top 10 MVPDs |

| iOS Tablets8 | 23,730,000 | All top 10 MVPDs |

| Samsung TV[9] | 14,740,800 | 4 of the top 10 MVPDs |

| Vizio TV9 | 12,151,200 | 0 |

| Apple TV[10] | 8,800,000 | N/A |

| Sony TV[9] | 8,764,800 | 1 of the top 10 MVPDs |

| PlayStation 4[7] | 8,650,000 | 2 of the top 10 MVPDs |

| Xbox One[7] | 7,790,000 | 2 of the top 10 MVPDs |

| LG TV[9] | 6,500,000 | 2 of the top 10 MVPDs |

| Roku[10] | 5,000,000 | 1 of the top 10 MVPDs |

| Chromecast[10] | 4,000,000 | 1 of the top 10 MVPDs |

| Total Number of Retail Devices | 469,849,800 |

It is worthwhile to review this Apps based approach. It is clearly the current trend for On-line Video Distributors (OVD) such as Netflix, Hulu, YouTube, etc. to write device specific apps, but also the trend among MVPDs. In addition to writing device specific apps for iOS and Android devices, MVPDs have also pursued approaches based on open standards from multi-stakeholder consortia, such as the Digital Living Network Alliance (DLNA), RVU Alliance, and the World Wide Web Consortium (W3C).

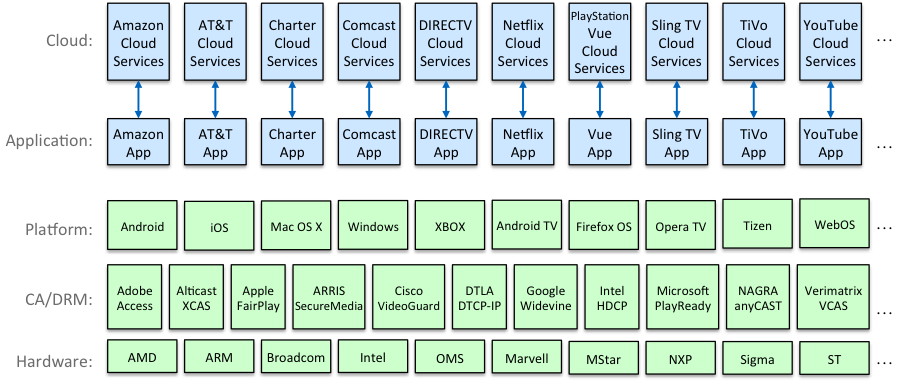

The following diagrams taken from Mark Vickers’, VP Software Architecture at Comcast, presentation at the August 4, 2015 DSTAC meeting describe the app-based approach.

The figure above shows the various service providers, both MVPD and OVD, and the various layers in the solution. At the bottom are the hardware platforms utilizing System on a Chip (SoC) from various silicon providers such as AMD, Broadcom, Intel, etc. Above that are the Conditional Access (CA) or Digital Rights Management (DRM) providers that port their security solutions to the respective hardware platforms. Above this are the various Operating System (OS) or software platforms, including Android, iOS, Mac OS X, Windows, etc. Above this are the service provider (MVPD or OVD) applications that utilize the cloud services to provide the service to the consumer. Finally, at the top are the cloud-based services specific to each provider that supports the respective service provider applications.

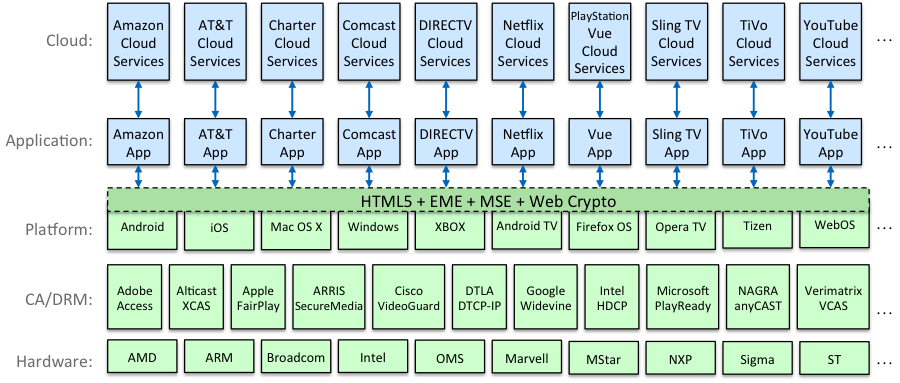

While this app-based model ensures that the service provider can take advantage of the latest features and capabilities of each new device, there is still room for broader reach. This is where new W3C specifications come into play.

The figure above shows how the W3C specifications for HTML5, Encrypted Media Extensions (EME), Media Source Extensions (MSE), and Web Crypto APIs provide a layer of abstraction from the underlying hardware, CA/DRM and OS platforms. The MVPDs and OVDs can write one HTML5 web app that runs across all platforms that support a compliant HTML5, EME, MSE, and Web Crypto implementation. As was noted in the Working Group 3 Report, not only do all of the commercial browsers support HTML5, EME, MSE, and Web Crypto APIs, but also all of the CA/DRM providers surveyed either plan to implement EME or already have EME implementations. Further, DLNA uses HTML5, EME, MSE, and Web Crypto APIs in its Remote User Interface (RUI) that are part of the DLNA VidiPath guidelines.

This app-based approach follows the latest trends on the Internet, using Cloud services, together with platform specific and/or Web apps to reach the broadest range of devices on which consumers demand their video be available. Importantly from a security perspective, it does not select a single security solution that can be targeted by hackers. And, from a marketplace perspective, it allows for competition amongst CA and DRM providers, while, at the same time, appearing basically seamless to the end user. Consumer device apps have become a competitive imperative, as MVPDs compete against each other and the growing number of OVDs in the market. As always, competition benefits the consumer.

Footnotes

[1] Common reliance is the concept that operator supplied equipment use the same security solution as retail devices to receive MVPD services.

[2] Conditional Access / Digital Rights Management

[3] Application Program Interface; a set of routines, protocols, and tools for building software applications.

[4] comScore Reports January 2015 U.S. Smartphone Subscriber Market Share, March 4, 2015 - http://www.comscore.com/Insights/Market-Rankings/comScore-Reports-January-2015-US-Smartphone-Subscriber-Market-Share

[5] Top 10 MVPDs – AT&T, Bright House, Cablevision, Charter, Comcast, Cox, DirecTV, DISH, Time Warner Cable, Verizon

[6] Computer and Internet Use in the United States: 2013 American Community Survey Reports, U.S. Department of Commerce Economics and Statistics Administration U.S. CENSUS BUREAU, November 2014 - http://www.census.gov/history/pdf/2013computeruse.pdf

[7] Platform Totals, VGChartz Limited, http://www.vgchartz.com/analysis/platform_totals/ (accessed: 6/18/15)

[8] THE STATE OF THE TABLET MARKET - http://tabtimes.com/resources/the-state-of-the-tablet-market/ (accessed: 6/18/15)

[9] Majority of US Internet Users to Use a Connected TV by 2015, eMarketer, June 13, 2014 - http://www.emarketer.com/Article/Majority-of-US-Internet-Users-Use-Connected-TV-by-2015/1010908 and Samsung, Vizio Control US smart TV market, Broadband TV News, MARCH 10, 2014 - http://www.broadbandtvnews.com/2014/03/10/samsung-vizio-control-us-smart-tv-market/

[10] Streaming devices sales in the United States in 2014 (in million units), Statista Inc. - http://www.statista.com/statistics/296641/streaming-devices-sales-united-states/ (accessed: 6/18/15)

Ralph Brown is Chief Technology Officer at CableLabs -

News

Join us at the CableLabs NDA Vendor Forum

Once a year CableLabs holds the NDA Vendor Forum. This is a unique opportunity for companies who are interested in developing technologies for the cable industry to get up to speed with the latest technology projects underway at CableLabs and to provide input on our technology development roadmap for the year ahead.

This year’s Forum comes at an exciting time for the industry. Our member companies in the U.S. and abroad are accelerating their plans to deploy gigabit services, expand the coverage and capabilities of their Wi-Fi networks, and offer new services that benefit subscribers at home and on the go. CableLabs project roadmap for 2015-16 reflects these priorities, and our success depends on the substantial technical expertise and engineering contributions from the vendor community.

Our Forum is in San Jose, CA this year, so we hope to see some new companies who may have not had the chance to attend one of our Forums. You’ll be able to network with CableLabs staff and other vendors, and get any of your questions answered with respect to technology projects at CableLabs.

If you are already an NDA vendor, register for the event. If you are interested in attending the, you’ll first need to a member of our NDA community. Please refer to our tutorial on How To Engage. There is no cost to join, and benefits of NDA membership (no cost) are numerous, and include the ability to review our technical specifications before they become public.

I look forward to seeing you in San Jose on the April 23.

Event Details

Thursday, April 23, 2015

8:00am to 6:00pm

Hilton San Jose, Downtown

300 S Almaden Blvd., San Jose, CA 95110

Ralph Brown is the Chief Technology Officer at CableLabs and can be reached at r.brown@cablelabs.com